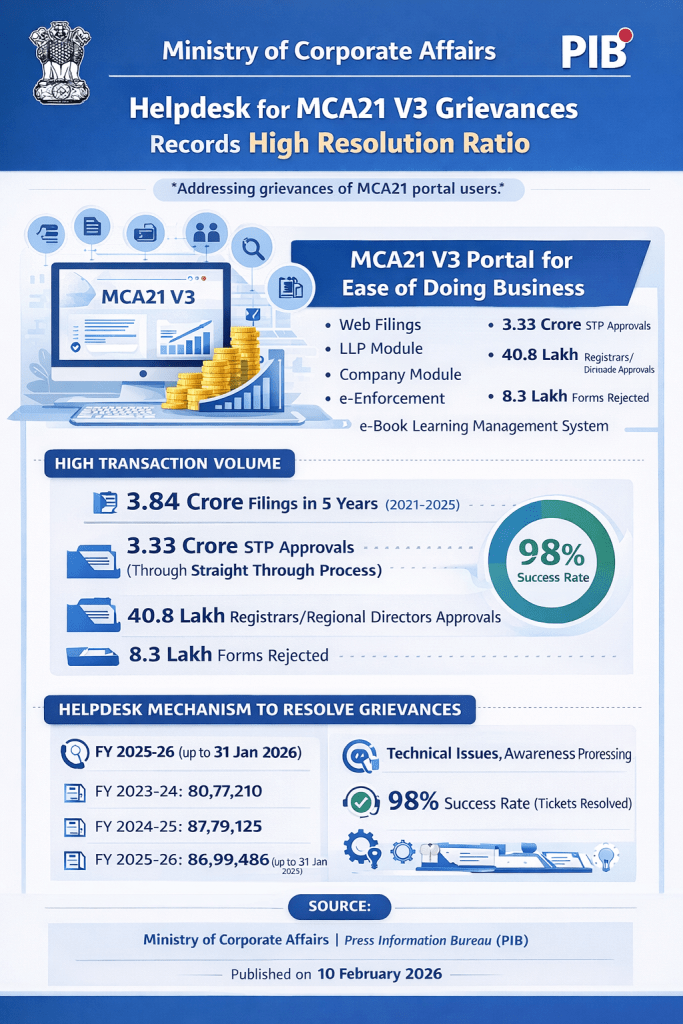

MCA21 V3 Portal:

- Version-3 of the MCA21 portal (MCA21 V3) has been launched to promote Ease of Doing Business, strengthen compliance, and enhance transparency.

- It includes functionalities such as Web filings, LLP Module, Company Module, e-Enforcement, e-Adjudication, e-Consultation, and e-Book Learning Management System.

Transaction Volume:

- Over the last five years (2021–2025), about 3.84 crore filings were made through MCA21.

- Of these, 3.33 crore filings were approved through Straight Through Process, 40.8 lakh filings were approved by Registrars/Regional Directors, and 8.3 lakh forms were rejected.

Recent Filings on MCA21 V3:

- FY 2023-24: 80,77,210 forms.

- FY 2024-25: 87,79,125 forms.

- FY 2025-26 (up to 31 Jan 2026): 86,99,486 forms.

Helpdesk Mechanism:

- A helpdesk mechanism to address grievances related to the MCA21 portal has been established.

- In FY 2025-26 (up to 31 Jan 2026), 3,16,877 helpdesk tickets were raised.

- About 98% of these tickets were successfully resolved.

Types of Issues Addressed: Helpdesk tickets included technical problems, awareness issues, processing-related queries, and stakeholder feedback/suggestions.

Context of Information: The data was shared by Shri Harsh Malhotra, Minister of State for Corporate Affairs and Road, Transport & Highways, in a written reply in Rajya Sabha.

Sources: Ministry of Corporate Affairs via PIB Delhi dated 10 Feb 2026