A. Purpose

This Circular consolidates earlier instructions issued by the Reserve Bank of India, on opening and operation of current accounts and CC/OD accounts with a view to enforce credit discipline amongst the borrowers as well as to facilitate better monitoring by the lenders.

B. Previous Instructions

This circular consolidates instructions contained in the following circulars issued on the above subject:

- DOR.No.BP.BC/7/21.04.048/2020-21 dated August 6, 2020

- DOR.No.BP.BC.27/21.04.048/2020-21 dated November 02, 2020

- DOR.No.BP.BC.30/21.04.048/2020-21 dated December 14, 2020

- DOR.CRE.REC.35/21.04.048/2021-22 dated August 4, 2021

- DOR.CRE.REC.63/21.04.048/2021-22 dated October 29, 2021

C. Applicability

The provisions of these instructions shall apply to current accounts and CC/OD accounts opened or maintained with the following Regulated Entities (REs):

All Scheduled Commercial Banks

All Payments Banks

D. Definitions

“Exposure” for the purpose of these instructions shall mean sum of sanctioned fund based and non-fund-based credit facilities availed by the borrower2. All such credit facilities carried in their Indian books shall be included for the purpose of exposure calculation.

“Banking System” for the purpose of these instructions, shall include Scheduled Commercial Banks and Payments Banks only.

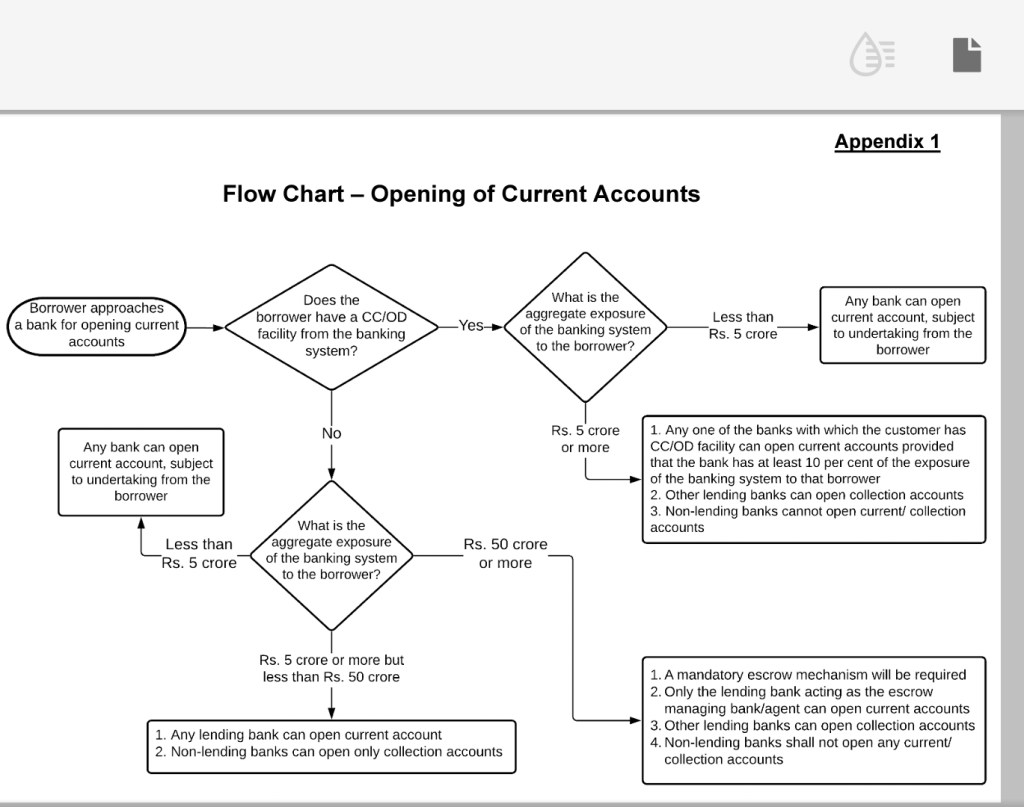

1. Opening of Current Accounts for borrowers availing Cash Credit/ Overdraft Facilities from the Banking System

1.1 For borrowers, where the aggregate exposure3 of the banking system is less than ₹5 crore, banks can open current accounts without any restrictions placed vide this circular subject to obtaining an undertaking from such customers that they (the borrowers) shall inform the bank(s), if and when the credit facilities availed by them from the banking system becomes ₹5 crore or more.

1.2 Where the aggregate exposure of the banking system is ₹5 crore or more:

1.2.1 Borrowers can open current accounts with any one of the banks with which it has CC/OD facility, provided that the bank has at least 10 per cent of the aggregate exposure of the banking system to that borrower. In case none of the lenders has at least 10 per cent of the aggregate exposure, the bank having the highest exposure among CC/OD providing banks may open current accounts.

1.2.2 Other lending banks may open only collection accounts subject to the condition that funds deposited in such collection accounts will be remitted within two working days of receiving such funds, to the CC/OD account maintained with the above-mentioned bank (para 1.2.1) maintaining current accounts for the borrower. The balances in such collection accounts shall not be used for repayment of any credit facilities provided by the bank, or as collateral/ margin for availing any fund or non-fund based credit facilities. However, banks maintaining collection accounts are permitted to debit fees/ charges from such accounts before transferring funds to CC/OD account.

1.2.3 Non-lending banks are not permitted to open current/ collection accounts.

2. Opening of Current Accounts for borrowers not availing Cash Credit/ Overdraft Facilities from the banking system

2.1 In case of borrowers where aggregate exposure of the banking system is ₹50 crore or more:

2.1.1 Banks shall be required to put in place an escrow mechanism. Borrowers shall be free to choose any lending bank as their escrow managing bank. All lending banks should be part of the escrow agreement. The terms and conditions of the agreement may be decided mutually by lending banks and the borrower.

2.1.2 Current accounts of such borrowers can only be opened/ maintained by the escrow managing bank.

2.1.3 Other lending banks can open ‘collection accounts’ subject to the condition that funds will be remitted from these accounts to the said escrow account at the frequency agreed between the bank and the borrower. Further, balances in such collection accounts shall not be used for repayment of any credit facilities provided by the bank, or as collateral/ margin for availing any fund or non-fund based credit facilities. While there is no prohibition on amount or number of credits in ‘collection accounts’, debits in these accounts shall be limited to the purpose of remitting the proceeds to the said escrow account. However, banks maintaining collection accounts are permitted to debit fees/ charges from such accounts before transferring funds to the escrow account.

2.1.4 Non-lending banks shall not open any current account for such borrowers.

2.2 In case of borrowers where aggregate exposure of the banking system is ₹5 crore or more but less than ₹50 crore, there is no restriction on opening of current accounts by the lending banks. However, non-lending banks may open only collection accounts as detailed at para 2.1.3 above.

2.3 In case of borrowers where aggregate exposure of the banking system is less than ₹5 crore, banks may open current accounts subject to obtaining an undertaking from them that they (the customers) shall inform the bank(s), if and when the credit facilities availed by them from the banking system becomes ₹5 crore or more. The current account of such customers, as and when the aggregate exposure of the banking system becomes ₹5 crore or more, and ₹50 crore or more, will be governed by the provisions of para 2.2 and para 2.1 respectively.

2.4 Banks are free to open current accounts of prospective customers who have not availed any credit facilities from the banking system, subject to necessary due diligence as per their Board approved policies.

2.5 Banks are free to open current accounts, without

any of the restrictions placed in this Circular, for borrowers having credit facilities only from NBFCs/ FIs/ co-operative banks/ non-bank institutions, etc. However, if such borrowers avail aggregate credit facilities of ₹5 crore or above from the banks covered under these guidelines, the provisions of the Circular shall be applicable.

3. Opening of Cash Credit/ Overdraft Facilities

3.1 When a borrower approaches a bank for availing CC/OD facility, the bank can provide such facilities without any restrictions placed vide this circular if the aggregate exposure of the banking system to that borrower is less than ₹5 crore. However, the bank must obtain an undertaking from such borrowers that they (the borrowers) shall inform the bank(s), if and when the credit facilities availed by them from the banking system becomes ₹5 crore or more.

3.2 For borrowers, where the aggregate exposure of the banking system is ₹5 crore or more:

3.2.1 Banks having a share of 10 per cent or more in the aggregate exposure of the banking system to such borrower can provide CC/OD facility without any restrictions placed vide this circular.

3.2.2 In case none of the banks has at least 10 per cent exposure, bank having the highest exposure among CC/OD providing banks can provide such facility without any restrictions.

3.2.3 Where a bank’s exposure to a borrower is less than 10 per cent of the aggregate exposure of the banking system to that borrower, while credits are freely permitted, debits to the CC/OD account can only be for credit to the CC/OD account of that borrower with a bank that has 10 per cent or more of aggregate exposure of the banking system to that borrower. Funds will be remitted from these accounts to the said transferee CC/OD account at the frequency agreed between the bank and the borrower. Further, the credit balances in such collection accounts shall not be used for repayment of any credit facilities provided by the bank, or as collateral/ margin for availing any fund or non-fund based credit facilities. However, banks are permitted to debit interest/ charges pertaining to the said CC/OD account and other fees/ charges before transferring the funds to the CC/OD account of the borrower with bank(s) having 10 per cent or more of the aggregate exposure. It may be noted that banks with exposure to the borrower of less than 10 per cent of the aggregate exposure of the banking system can offer working capital demand loan (WCDL)/ working capital term loan (WCTL) facility to the borrower.

3.2.4 In case there is more than one bank having 10 per cent or more of the aggregate exposure, the bank to which the funds are to be remitted may be decided mutually between the borrower and the banks.

4. Exemptions Regarding Specific Accounts

4.1 Banks are permitted to open and operate the following accounts without any of the restrictions placed in terms of paras 1, 2 and 3 of this Circular:

(a) Specific accounts which are stipulated under various statutes and specific instructions of other regulators/ regulatory departments/ Central and State Governments. An indicative list of such accounts is given below:

- Accounts for real estate projects mandated under Section 4 (2) l (D) of the Real Estate (Regulation and Development) Act, 2016 for the purpose of maintaining 70 per cent of advance payments collected from the home buyers

- Nodal or escrow accounts of payment aggregators/ prepaid payment instrument issuers for specific activities as permitted by Department of Payments and Settlement Systems (DPSS), Reserve Bank of India under Payment and Settlement Systems Act, 2007

- Accounts for the purpose of IPO/ NFO/ FPO/ share buyback/ dividend payment/ issuance of commercial papers/ allotment of debentures/ gratuity etc. which are mandated by respective statutes or by regulators and are meant for specific/ limited transactions only

(b) Accounts opened as per the provisions of Foreign Exchange Management Act, 1999 (FEMA) and notifications issued thereunder including any other current account if it is mandated for ensuring compliance under the FEMA framework

(c) Accounts for payment of taxes, duties, statutory dues, etc. opened with banks authorized to collect the same, for borrowers of such banks which are not authorized to collect such taxes, duties, statutory dues, etc.

(d) Accounts for settlement of dues related to debit card/ ATM card/ credit card issuers/ acquirers

(e) Accounts of White Label ATM Operators and their agents for sourcing of currency

(f) Accounts of Cash-in-Transit (CIT) Companies/ Cash Replenishment Agencies (CRAs) for providing cash management services

(g) Accounts opened by a bank funding a specific project for receiving/monitoring cash flows of that specific project, provided the borrower has not availed any CC/OD facility for that project

(h) Inter-bank accounts

(i) Accounts of All India Financial Institutions (AIFIs), viz., EXIM Bank, NABARD, NHB, and SIDBI

(j) Accounts attached by orders of Central or State governments/ regulatory body/ Courts/ investigating agencies etc. wherein the customer cannot undertake any discretionary debits

4.2 Banks maintaining accounts listed in para 4.1 shall ensure that these accounts are used for permitted/ specified transactions only. Further, banks shall flag these accounts in the CBS for easy monitoring. Lenders to such borrowers may also enter into agreements/ arrangements with the borrowers for monitoring of cash flows/ periodic transfer of funds (if permissible) in these accounts.

5. Other Instructions

5.1 In case of borrowers covered under guidelines on loan system for delivery of bank credit issued vide circular DBR.BP.BC.No.12/21.04.048/2018-19 dated December 5, 2018, bifurcation of working capital facility into loan component and cash credit component shall continue to be maintained at individual bank level in all cases, including consortium lending

5.2 All banks, whether lending banks or otherwise, shall monitor all accounts regularly, at least on a half-yearly basis, specifically with respect to the aggregate exposure of the banking system to the borrower, and the bank’s share in that exposure, to ensure compliance with these instructions. If there is a change in exposure of a particular bank or aggregate exposure of the banking system to the borrower which warrants implementation of new banking arrangements, such changes shall be implemented within a period of three months from the date of such monitoring.

5.3 Banks shall put in place a monitoring mechanism, both at head office and regional/ zonal office levels to monitor non-disruptive implementation of the circular and to ensure that customers are not put to undue inconvenience during the implementation process.

5.4 Banks should not route drawal from term loans through CC/ OD/ Current accounts of the borrower. Since term loans are meant for specific purposes, the funds should be remitted directly to the supplier of goods and services. In cases where term loans are meant for purposes other than for supply of goods and services and where the payment destination is identifiable, banks shall ensure that payment is made directly, without routing it through an account of the borrower. However, where the payment destination is unidentifiable, banks may route such term loans through an account of the borrower opened as per the provisions of the circular. Expenses incurred by the borrower for day-to-day operations may be routed through an account of the borrower.

/

/