Prime Minister Internship Scheme Launched to Provide 1 Crore Internships in Top Companies Over Five Years

Successful Migration of MCA21 from Version 2 to Version 3 for Streamlined Compliance

Jan Vishwas Initiatives Simplify Share Transmission and Lost Share Certificate Processes, Eliminates Surety Requirements for Duplicate Physical Security Certificates

IEPFA Launches Enhanced Grievance Redressal Mechanism with Multilingual IVRS Facility

Integrated Technology Platform Proposed Under Insolvency and Bankruptcy Code for Better Efficiency

IBC Resolves Rs. 10.22 Lakh Crore Default Cases Pre-Admission with Record Resolution Rates

Competition Commission of India (CCI) Disposes 99% of Combination Cases by September 2024

Central Processing Centre (CPC) Launched for Nationwide E-Form Processing

CPACE Reduces Corporate Exit Processing Time to 90 Days

Amendments Introduced in Indian Accounting Standards (Ind AS 116 and Ind AS 117)

Faceless Adjudication Mechanism Introduced for Decriminalized Corporate Defaults

The major initiatives and achievements of the Ministry of Corporate Affairs during the Year 2024 are as follows:

Prime Minister’s Internship Scheme – Pilot Project

The Prime Minister’s Internship Scheme in Top Companies has been announced in the Budget 2024 aiming to provide internship opportunities to one crore youth in top 500 companies over five years.

Through this Scheme, youth will gain exposure to real-life business environment, across varied professions and employment opportunities.

The interns will be provided with financial assistance of Rs. 5,000 per month, of which Rs. 4500 would be disbursed by the union government, and Rs. 500 per month would be paid by the company from its CSR funds.

Additionally, a one-time grant of Rs. 6,000 for incidentals would be disbursed by Ministry of Corporate Affairs (MCA) to each intern, upon joining the place of internship.

Duration of the internship under the PM Internship Scheme is of 12 months.

A Pilot Project of the Scheme, targeted at providing 1.25 lakh internship opportunities during FY 2024-25, has been launched on 3rd October 2024 through an online portal, accessible at http://www.pminternship.mca.gov.in.

Partner companies have posted approximately 1.27 lakh internship opportunities on the portal.

Approximately 4.87 lakh youths have completed their KYC and registered themselves on the portal.

Approximately 6.21 lakh applications have been received against 1.27 lakh Internship Opportunities. The selection process for internship is ongoing.

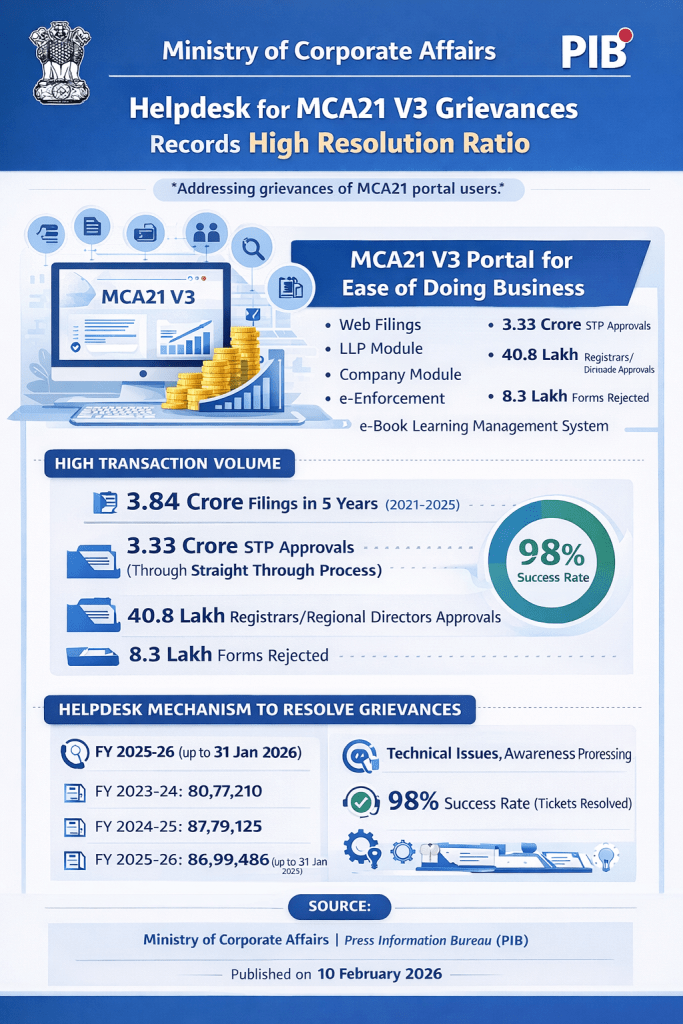

Migration of MCA V2 to V3: Enhancing Efficiency and Compliance

IEPFA has successfully migrated forms from MCA 21 Version 2 to Version 3, introducing significant improvement to streamline the compliance process.

The number of compliance forms has been reduced from 5 to 3, simplifying submission requirements for companies.

Additionally, the process of transferring funds has been made fully online, with all company forms now integrated into a Straight Through Process (STP), eliminating the need for manual intervention.

To further facilitate this change, a dedicated dashboard has been implemented for Nodal Officers, allowing them to easily track and file verification reports for claims.

Major Initiative Under Jan Vishwas

(1)-Recognition of Legal Heirship Certificate for Share Transmission

The legal heirship certificate has been officially recognized as a valid instrument for registering the transmission of shares. This important development, applicable to shares transferred to the IEPF by companies under Section 124(6) of the Companies Act, 2013, eliminates the need for a monetary threshold.

This reform significantly reduces the burdens on individuals by removing the requirement to obtain a succession certificate, letter of administration, or probate of a will. As a result, beneficiaries can save both time and costs that were previously associated with civil court procedures. This initiative not only simplifies the transmission process for shares but also enhances accessibility and efficiency for families experiencing complexities of inheritance.

(2)Simplification of Processes for Lost Share Certificates

In a progressive move aimed at claimants, the requirement to file an FIR for the loss of physical share certificates for securities valued up to Rs. 5 lakhs have been eliminated. This change streamlines the process for individuals who may have lost their share certificates, reducing the bureaucratic hurdles they face.

(3)Elimination of Surety Requirements for Duplicate Physical Security Certificates

In a significant reform, the requirement for sureties when applying for duplicate physical security certificates has been eliminated for all values. This crucial change aims to simplify the process for claimants who may need to replace lost or damaged certificates, thus removing unnecessary barriers and enhancing accessibility.

Enhanced Grievance Redressal Mechanism

IEPFA has augmented its grievance redressal mechanism to provide a more effective and user-friendly experience for stakeholders.

The Authority has introduced an intuitive call centre solution equipped with Interactive Voice Response System (IVRS) facilities available in six languages, ensuring accessibility for a diverse audience.

Additionally, the call centre operates through a convenient five-digit short code – 14453, simplifying the process for users to seek assistance and address their concerns. This enhancement reflects IEPFA’s commitment to improving communication and support for claimants, ensuring that their grievances are addressed swiftly and efficiently.

To enhance accessibility, increase interactivesness; bring financial inclusiveness and engagement with stakeholders, IEPFA successfully conducted

Niveshak Sunwai Initiatives in Mumbai and Ahmedabad;

Niveshak Panchayat: Bridging the Gap Between Claimants and IEPFA;

Niveshak Didi: Empowering Women through Financial Literacy;

Niveshak Saarthi: Embracing Financial Inclusivity.

Setting of an Integrated Technology Platform under the IBC:

The Government is considering setting up an Integrated Technology Platform under the Insolvency and Bankruptcy Code, 2016.

It may provide for an integrated case management system for processes under the IBC, automated processes to file applications with the Adjudicating Authority, delivery of notices, enable interaction of Insolvency Professions with stakeholders, storage of records of the corporate debtor, and incentivise effective participation of stakeholders.

The Integrate Technology Platform would lead to better transparency, minimisation of delays, effective decision making and better oversight of the processes by the authorities.

Achievements/performance of the Insolvency and Bankruptcy Code, 2016:

The IBC has introduced a new era of transparency and fairness in insolvency resolutions.

It ensures equitable treatment of all stakeholders, with a clear and predictable resolution process.

Till March 2024, 28,818 applications for initiation of CIRPs, having underlying default of Rs. 10.22 lakh crore were resolved before their admission. This is attributed to the behavioural change in debtor creditor relationship effectuated by the Code.

Till September 2024, 1068 CIRPs have culminated in resolution plans, achieving on average 86.13% of the fair value of the Corporate Debtor (CD). Creditors have realised Rs. 3.55 lakh crore under the said resolution plans.

By June 2024, the IBC successfully navigated 3,409 CDs through the insolvency process, with 1068 achieving resolutions through plans and the remainder through appeals, reviews, settlements, or withdrawals. The resolution of these CDs has led to a realization rate of over 161% against liquidation value. The average expense incurred in the resolution processes is remarkably low, standing at only 1.37% of the liquidation value and 0.83% of the resolution value.

Competition Commission of India (CCI) achievements:

Since its inception, the Competition Commission of India (CCI) has received 1289 antitrust matters (Sections 3 & 4) and has disposed of 1157 (90% approx.) cases till September, 2024.

Further, from January 2024 to September 2024, the Commission received 30 new cases and disposed 30 cases (including carry forward cases from previous year).

The Commission considered and approved mergers and acquisitions relating to various sectors of the economy such as Financial Markets, Power & Power Generation, Pharmaceuticals & Healthcare, and Digital Markets.

Since its inception, the Commission has received 1191 combination matters (Sections 5 & 6) and has disposed of 1179 (99 % approx.). Further, from January 2024 to September 2024, the Commission received 91 new cases and disposed 101 cases (including carry forward cases from previous year). Seventeen (17) letters were issued to the parties out of Two hundred and ninety-one (291) transactions seen in Media scanning.

CCI initiated a Study on “Competition Issues in Renewable Energy Sector across BRICS Nations”.

The study report is being prepared based on inputs received from the competition authorities of BRICS nations.

Increased Compliance and Filing Rates:

Over the past two years, the Ministry has significantly improved compliance with Section 148 of the Companies Act, 2013.

This progress is evident from a substantial increase in the filings of e-Form CRA-2(Intimation of Appointment of Cost Auditor) and e-Form CRA-4 (Filing of Cost Audit Report). Specifically, there has been a 35% increase in e-Form CRA-2 filings and a 36% rise in e-Form CRA-4 filings in the fiscal year 2023-24 compared to2021-22.

Proactive Advisory Initiatives:

From the financial year 2023-24, the Ministry has proactively issued regular advisories to companies, emphasizing the importance of adhering to the prescribed timelines for filing Cost Audit Reports.

This initiative has led to a 14% increase in the timely submission of Cost Audit Reports during 2023-24 compared to the previous year.

Examination of Existing Framework of Cost Audit and its Rules:

To review the existing framework of Cost Records and Cost Audit and to improve the usefulness of the Cost Audit Reports in various sectors of the economy, a Committee was constituted in October, 2023 by MCA.

The Committee’s report has been placed on the website of MCA inviting comments from the stakeholders.

Based on the stakeholders comments, recommendations of the Committee will be examined and framework governing Cost Record and Audit will be amended.

Newly established office i.e., Central Processing Centre (CPC) in the year 2024.

The Central Processing Centre (CPC) was launched in 2024. CPC was established for discharging or carrying out the function of processing and disposal of such e-forms, as may be prescribed under the provisions of the Companies Act, 2013.

The CPC shall also exercise functional jurisdiction of processing and disposal of e-forms and all related matters pertaining to statutory compliances under the Companies Act, 2013 having territorial jurisdiction all over India and any other e-forms as may be notified by the Central Government, filed along with the prescribed fee as provided in the Companies (Registration of Offices and Fees) Rules, 2014″.

Empowering the Regional Directors

Rule 25A of Companies and (Compromises, Arrangements Amalgamations) Rules, 2016 [CAA Rules] has been amended on 9th Sep. 2024 (effective from 17.9.2024) empowering the Regional Directors (RDs) to approve petitions for mergers between a holding company incorporated outside India with a wholly owned subsidiary incorporated in India in a time bound manner, instead of NCLT.

The Ministry has also issued Companies (Listing of Equity Shares in Permissible Jurisdictions) Rules, 2024 on 24th January, 2024 to allow Indian companies to list their equity shares on Gift IFSC International stock exchanges. The “Direct Listing of Equity Shares of Companies Incorporated in India on International Exchanges Scheme” has also been issued by D/o Economic Affairs.

Amendment in Companies (Indian Accounting Standards) Rules, 2015 has been effected to bring changes in Ind AS 116 and introduction of Ind AS 117 as follows:

Ind AS 116: Amendment in Ind AS 116 has been made vide G.S.R. 554(E) dated 09.09.2024, which involves the treatment of leaseback transactions. A new paragraph, 102A, has been added to Ind AS 116, for right-of-use assets and lease liabilities arising from sale and leaseback transactions.

Ind AS 117: Vide the notification no. G.S.R. 492 (E) dated 12th August 2024, the Indian Accounting Standard (Ind AS) 117 has been introduced, in respect of insurance contracts.

Centre established for Processing Accelerated Corporate Exit (CPACE)

Fulfilling budget and announcement (2022-23), a Centre established for Processing Accelerated Corporate Exit (CPACE) for expeditious processing of applications filed for voluntary closure of companies, with an aim of bringing down the number of days taken for such closure from about 2 years to less than 6 months.

Since commencement of C-PACE on 01.05.2021, the average number of days for closure has reduced to about 90 days during the FY 2023-24. It is now centralized and the applications filed for voluntary closure of L.L.Ps are also with C-PACE to ensure their expeditious processing as well.

The CPACE for processing closure applications of LLPs was notified on 05th August, 2024 effective from 27th August, 2024.Since inception on 27th August, 2024 and upto 7th December, 2024, 4640 applications of LLP closure have been disposed of by the CPACE.

Amendments in Companies Act, 2013, and L.L.P Act 2008,

Through gradual amendments in Companies Act, 2013, and L.L.P Act 2008, 63 provisions have been decriminalized bringing defaults under such provisions under in-house adjudication mechanism. At present, Registrar of Companies (RoC) are adjudicating cases of defaults, wherein representatives of corporates have to attend hearings ‘in person’. The adjudication mechanism has been made electronic and faceless to eliminate interactions in person during adjudicatory process at RoC level.

****

NB/AD

Release Id :-2088711