In exercise of the powers conferred by sub-sections (1), (2) and (4) of section 248 read with section 469 of the Companies Act, 2013 (18 of 2013), the Central Government hereby makes the following rules further to amend the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016 , namely:-

1. Short title and commencement.- (1) These rules may be called the Companies (Removal of Names of Companies from the Register of Companies) Amendment Rules, 2022. (2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016, –

I. in rule 4, after sub-rule (3), the following sub-rule shall be inserted, namely:─

“(4) (a) Where the Registrar, on examining the application made in Form STK-2, finds that it is necessary to call for further information or finds such application or any document annexed therewith is defective or incomplete in any respect, he shall inform to the applicant to remove the defects and re-submit the complete Form within fifteen days from the date of such information, failing which the Registrar shall treat the Form as invalid in the electronic record, and shall inform the applicant, accordingly.

(b) After the re-submission of the Form or document, if the Registrar finds that the Form or document is defective or incomplete in any respect, he shall give further time of fifteen days to remove such defects or complete the Form, failing which the Registrar shall treat the Form as invalid in the electronic record and shall inform the applicant, accordingly.

(c) Any re-submission of the application in Form STK-2 made prior to the commencement of the Companies (Removal of Names of Companies from the Register of Companies) Amendment Rules, 2022 shall not be counted for the purposes of reckoning the maximum number of re-submissions of such Form.”.

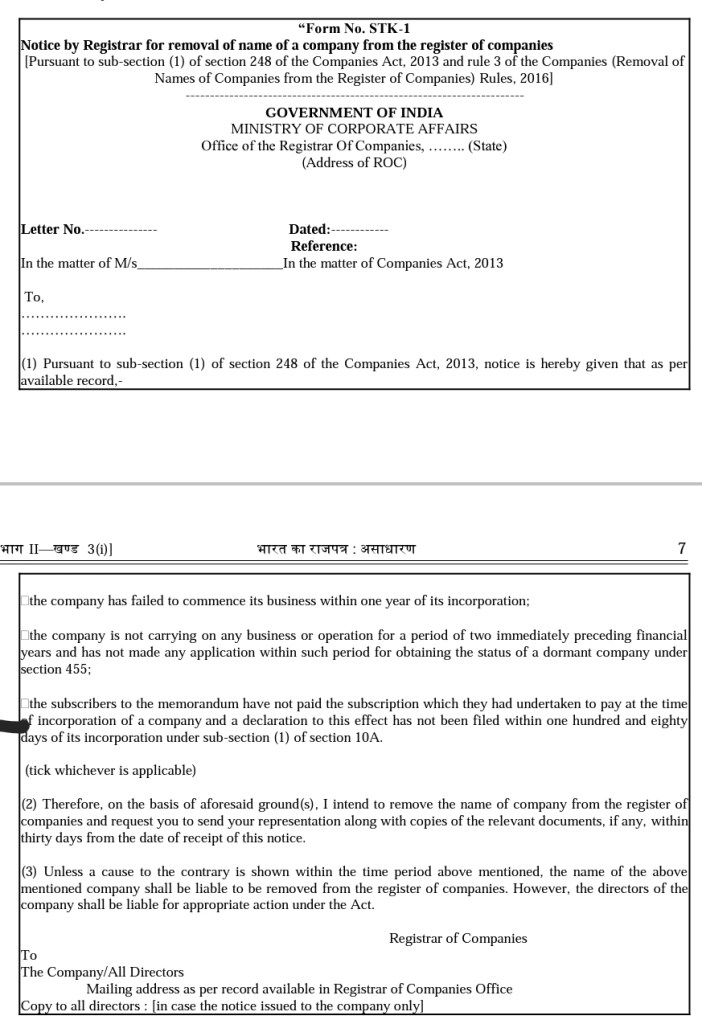

II. for Form No. STK 1, Form No. STK – 5 and Form No. STK-5A, the following Forms shall respectively, be substituted, namely:-