- Central Database:

- Government maintains a central database of Corporate Social Responsibility (CSR) expenditures filed by companies in the MCA 21 registry.

- All CSR data (state-wise, year-wise, company-wise, project-wise) is publicly available on http://www.csr.gov.in.

- CSR Governance Framework:

- CSR is a Board-driven process under the Companies Act, 2013.

- Boards are responsible for planning, executing, and monitoring CSR activities.

- Transparency & Accountability Provisions:

- Legal requirements include:

• formation of CSR Committee,

• CSR Policy,

• Annual Action Plan on CSR,

• CFO certification of CSR expenditure,

• statutory audit of CSR expenditure.

- Legal requirements include:

- Impact Assessment Rule:

- Under Rule 8 of Companies (CSR Policy) Rules, 2014:

• Companies with average CSR obligation ≥ ₹10 crore (last 3 FYs) must undertake impact assessment for CSR projects with outlays ≥ ₹1 crore, completed at least one year before assessment.

• Impact details must be included in the company’s Annual CSR Report (as part of Board’s report).

- Under Rule 8 of Companies (CSR Policy) Rules, 2014:

- CSR Spending Obligation:

- No fixed allocation of CSR funds in the law.

- Companies must spend at least 2% of average net profits (last 3 FYs) on CSR activities specified in Schedule VII of the Act.

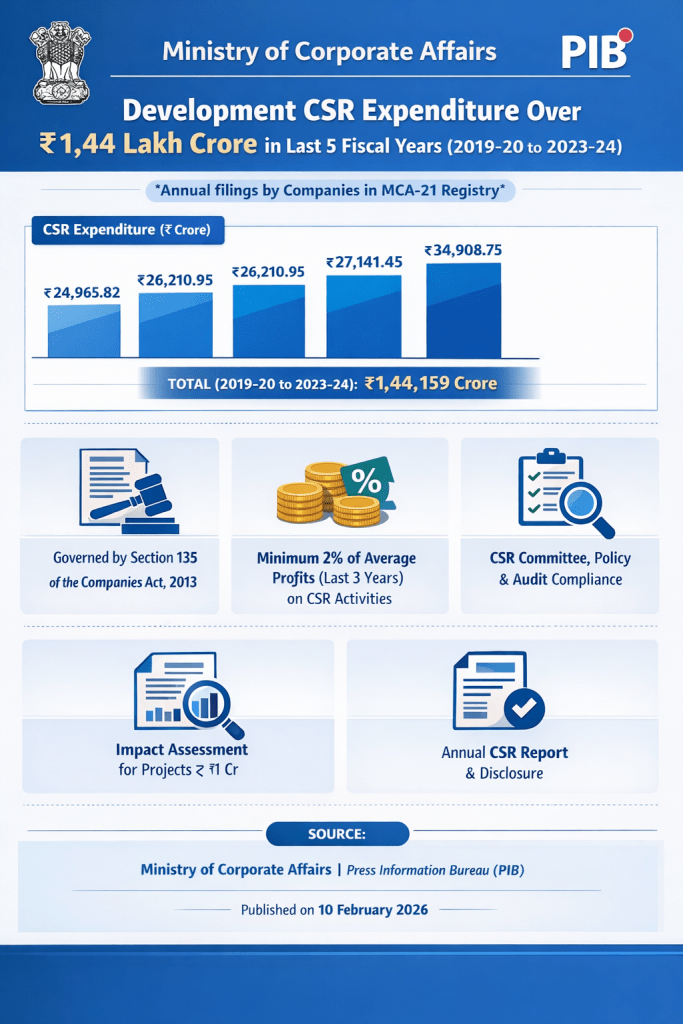

- Development CSR Expenditure (Last 5 FYs):

- FY 2019-20: ₹24,965.82 Crore

- FY 2020-21: ₹26,210.95 Crore

- FY 2021-22: ₹27,141.45 Crore

- FY 2022-23: ₹30,932.08 Crore

- FY 2023-24: ₹34,908.75 Crore

- Total (2019-20 to 2023-24): Over ₹1,44,159 Crore.

- Source of Information:

- Provided by Shri Harsh Malhotra, Minister of State for Corporate Affairs and Road, Transport & Highways, in a written reply in Rajya Sabha.