The Competition Commission of India (CCI) has received cases against companies (including e-commerce companies) for alleged abuse of dominant position and anti-competitive practices. This was stated by Union Minister of State for Corporate Affairs Shri Rao Inderjit Singh in a written reply to a question in Lok Sabha today.

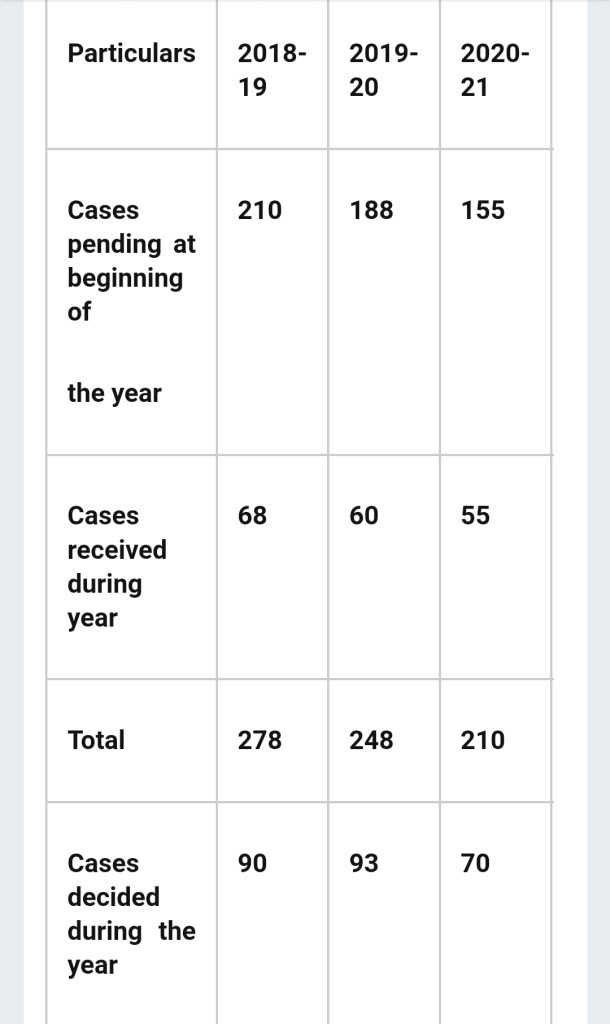

Giving more details, the Minster stated that cases received against companies (including e-commerce companies) during the last three years including the present year are as under:-

* Data as on 28.02.2022

As on 28.02.2022, the Minister stated, the CCI has received a total of 1180 cases under Sections 3 and 4 of the Act. Of these, 1046 cases have been disposed of and 04 cases have been quashed/ set aside by the Courts. Thus, 88.64% of the total cases filed so far stand disposed of.

The Minister stated that Section 4 of the Competition Act, 2002 (‘Act’) prohibits abuse of dominant position by enterprises or their groups. E-commerce companies are covered within the ambit of the provisions of the Act.

The Minister further stated that the CCI has been undertaking various initiatives from time to time to ensure effective competition and fair play in the market. These, inter-alia, include:

- conducting market studies on relevant sectors

- undertaking competition assessment of Model Concession Agreements in the infrastructure and other public delivery sectors

- advocacy outreach initiatives including State Resource Person Schemes and conducting roadshows on competition laws & practices

- upgradation of IT infrastructure and increased use of technology in functioning

- opening of regional offices

- introduction of green channel for certain combination notifications

- collaboration with other international anti-trust authorities etc.

The CCI, the Minister stated, in the recent past had undertaken a “Market Study on E-Commerce in India” to better understand the functioning of e- commerce in India and its implications for markets and competition. The Report enumerates certain areas for self-regulation by the e-commerce platforms, which include:

- transparency in search ranking parameters

- clear and transparent policy on the actual and potential use of data collected by platforms

- adequate transparency over user review and rating mechanisms

- notification to business users regarding proposed revision in contract terms; and

- clear and transparent policies on discounts including discount rate and participation in discount schemes.

****

RM/KMNRelease Id :-1805999